retroactive capital gains tax reddit

Biden plans to increase this. Issue Date December 1988.

How Could Changing Capital Gains Taxes Raise More Revenue

Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year.

. Depending on the jurisdiction income taxes are calculated and collected in a variety of ways. As MarketWatch points out the change primarily. Up until now the tax rate on capital gain has been zero 15 or 20 depending on your income.

35m members in the Bitcoin community. A Retroactive Capital Gains Tax Increase. One of the big surprises included in President Joe Bidens first budget is the retroactive application of the near 100 capital gains tax hike.

In some cases you add the 38. Are retroactive tax increases constitutional or even fair. If not retroactively then likely by January 1 2022.

Up until now the tax rate on capital gain has been zero 15 or 20 depending on your income. Are retroactive tax increases constitutional or even fair. 13 votes 32 comments.

President Biden really is a class warrior. This paper presents a new approach to the taxation of capital gains that eliminates the deferral advantage present under current realization-based systems along. Income taxes are taxes that are collected on the individual earnings of persons or entities.

With this retroactive income tax. A community dedicated to Bitcoin the currency of the Internet. Whats clear is that a capital gains tax hike is almost certainly on its way.

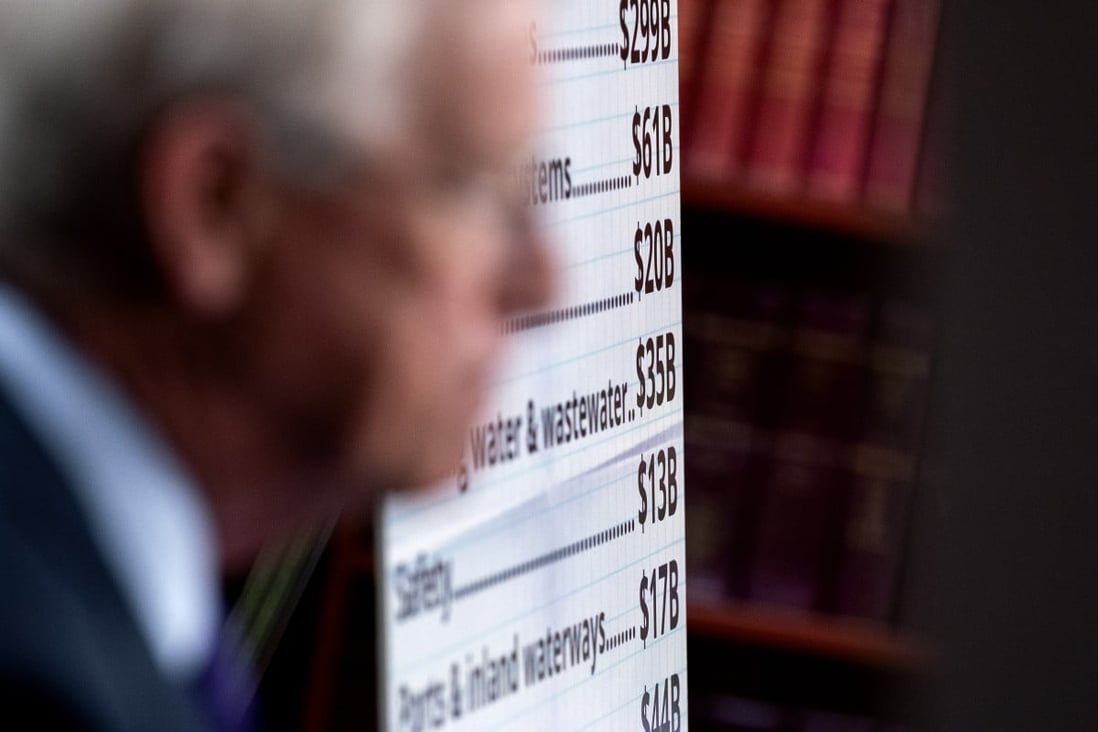

The Franchise Tax Boards move has the potential to have a chilling effect on business creation and entrepreneurship said Brian Overstreet a California entrepreneur who started rallying. 398 votes and 56 comments so far on Reddit. Not only does he want to raise taxes on capital gains to a modern high of 434 he wants to do it retroactively.

Washington State Capital Gains Tax Marches On What The New Law Would Do And Who Is Affected Geekwire

How To Calculate Capital Gain On House Property Yadnya Investment Academy

How High Are Capital Gains Taxes In Your State Tax Foundation

What Are The Pros And Cons Of Taxing Capital Gains As Ordinary Income R Neutralpolitics

What Are The Pros And Cons Of Taxing Capital Gains As Ordinary Income R Neutralpolitics

Understanding The 1994 Capital Gains Tax Election Moneysense

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

How To Pay 0 Capital Gains Taxes With A Six Figure Income

How To Prepare For A Retroactive Capital Gains Tax Hike Thinkadvisor

Read This On The New Capital Gains Tax Proposal On Page 61 In Other Words They Want To Tax Anybody That Gain Over 1 000 000 37 In Which It Will Help Prevent Economy

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Capital Gains Tax What Is It And How It Applies To Your Crypto Coinbase

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

Bonus Depreciation 5 Key Points Sensiba San Filippo

Home Selling Will I Have To Pay Capital Gains Taxes Ariel J Baverman Property Consultant In Atlanta Ga

Tech Stocks And Fat Valuations Seen As At Risk In Biden S 43 Per Cent Tax On Wealthy Americans South China Morning Post

Biden Plans Retroactive Hike In Capital Gains Taxes So It May Be Already Too Late For Investors To Avoid It Report R Politics